The 7-Second Trick For 1031 Exchange Rules

Table of ContentsSome Known Factual Statements About 1031 Exchange Fund The Single Strategy To Use For 1031 Exchange FundThe Definitive Guide to 1031 Exchange CaliforniaThe Best Guide To Real Estate Investment Companies CaliforniaThe Main Principles Of 1031 Exchange Fund

In actual estate, a 1031 exchange is a swap of one investment property for one more that enables capital gains tax obligations to be postponed. The termwhich gets its name from Internal Revenue Code (IRC) Section 1031is bandied about by real estate representatives, title firms, capitalists, and also soccer mommies. Some individuals also firmly insist on making it into a verb, as in, "Allow's 1031 that building for one more." IRC Section 1031 has many relocating parts that actual estate capitalists should understand prior to attempting its use. There are additionally tax ramifications and also time frames that might be troublesome (1031 exchange into a fund). If you are taking into consideration a 1031or are simply curioushere is what you should learn about the policies. Secret Takeaways A 1031 exchange is a swap of residential or commercial properties that are held for organization or financial investment functions. The residential or commercial properties being traded should be considered like-kind in the eyes of the Internal Profits Service (IRS) for funding gains tax obligations to be deferred.The policies can relate to a previous key home under really certain conditions. What Is Area 1031? Generally mentioned, a 1031 exchange (also called a like-kind exchange or a Starker) is a swap of one investment residential property for another. The majority of swaps are taxable as sales, although if yours meets the requirements of 1031, after that you'll either have no tax or restricted tax due at the time of the exchange.

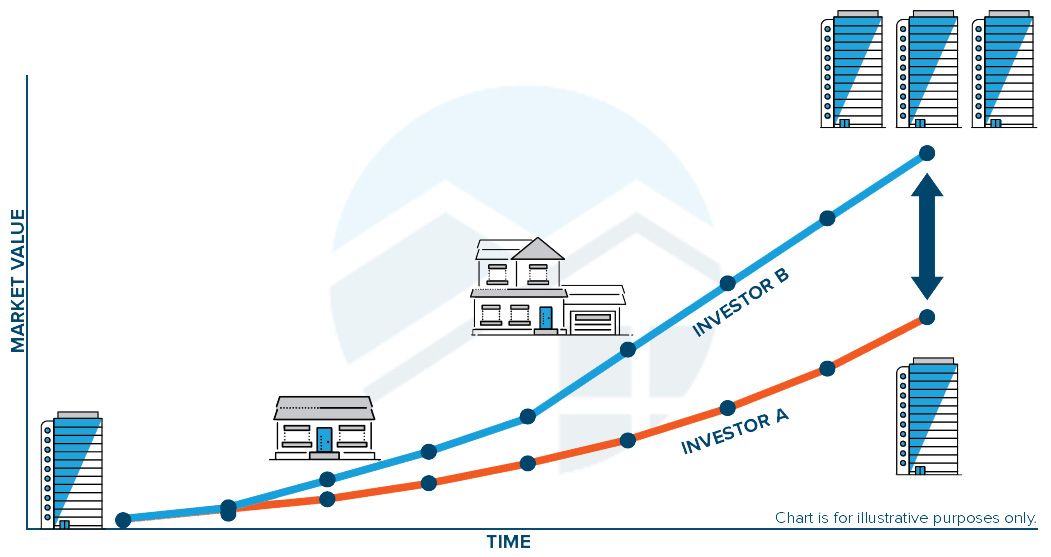

There's no restriction on just how frequently you can do a 1031. You might have a revenue on each swap, you avoid paying tax up until you sell for money many years later.

Little Known Questions About What Is A 1031 Exchange.

To qualify, a lot of exchanges need to merely be of like-kindan enigmatic expression that does not imply what you think it implies (you could check here). You can exchange an apartment for raw land, or a cattle ranch for a strip mall. The rules are remarkably liberal. You can even trade one service for an additional. There are traps for the reckless.

There are additionally manner ins which you can utilize 1031 for exchanging trip homesmore on that particular laterbut this loophole is much narrower than it used to be. To qualify for a 1031 exchange, both properties should be located in the United States. Unique Regulations for Depreciable Property Unique guidelines use when a depreciable residential or commercial property is traded.

In basic, if you exchange one structure for another structure, you can avoid this regain. Such problems are why you need professional assistance when you're doing a 1031.

The Greatest Guide To 1031 Exchange Rules California 2022

Now, just real home (or actual estate) as defined in Section 1031 qualifies. It's worth keeping in mind, nevertheless, that the TCJA complete expensing allocation for specific concrete individual residential or commercial property might assist to make up for this adjustment to tax obligation law. The TCJA consists of a change policy that permitted a 1031 exchange of qualified personal building in 2018 if the initial residential or commercial property was sold or the substitute building was obtained by Dec.

How 1031 Exchange Real Estate can Save You Time, Stress, and Money.

Yet the odds of finding someone with the exact property that you want that wants the specific property that you have are slim. For that reason, the majority of exchanges are delayed, three-party, or Starker exchanges (named for the first tax obligation case that allowed them). In a delayed exchange, you need a qualified intermediary (middleman), who holds the cash money after you "market" your residential property and utilizes it to "buy" the replacement property for you.

The IRS says you can mark 3 buildings as long as you at some point close on one of them. You can even assign more than three if they fall within particular assessment tests. 180-Day Rule The second timing guideline in a postponed exchange right here connects to closing. You should close on the brand-new home within 180 days of the sale of the old residential property.

Not known Details About Tax Shelter Real Estate

1031 Exchange Tax Ramifications: Cash Money as well as Financial debt You may have cash left over after the intermediary acquires the replacement property. If so, the intermediary will certainly pay it to you at the end of the 180 days. why not try these out. That cashknown as bootwill be taxed as partial sales proceeds from the sale of your residential property, typically as a capital gain.

If you don't obtain cash back yet your responsibility goes down, then that additionally will be dealt with as earnings to you, just like cash. Intend you had a home mortgage of $1 million on the old residential property, but your mortgage on the brand-new home that you receive in exchange is only $900,000.